Consider market ramifications of US-North Korea tension

Since Kim Jong-un took leadership of North Korea after his father, Kim Jong-il, died in 2011, North Korea has been conducting heavy research on nuclear tests and missiles. Some analysts argue that their fierce rhetoric on nuclear power is just to strengthen their international standing, but their motives remain in question. Whatever the purpose is, the ramp-up is creating anxieties.

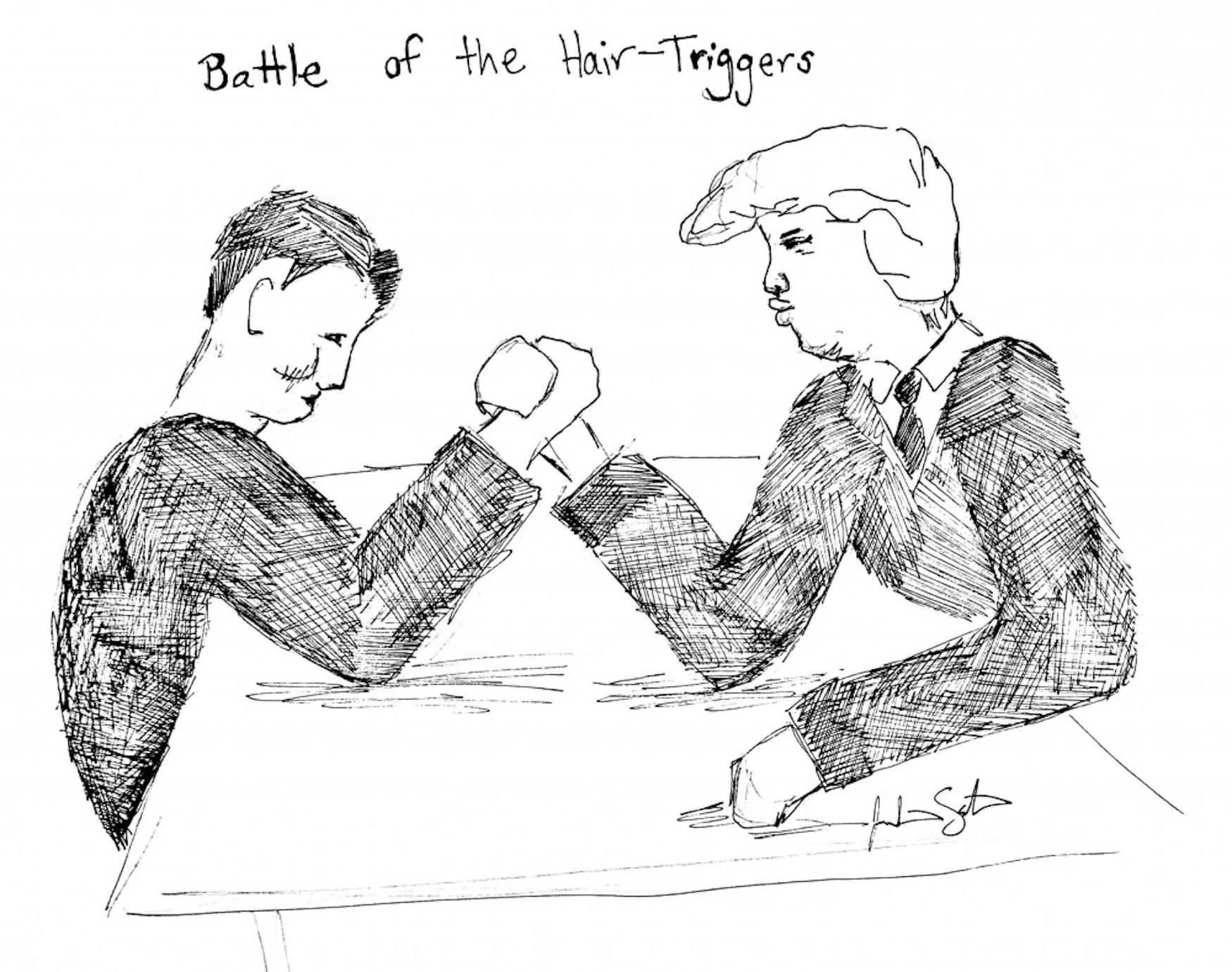

The tension between North Korea and the United States — or the Trump administration to be specific — peaked last August. In August 2017, President Donald Trump stated, “As I said, they will be met with fire, fury, and frankly power, the likes of which this world has never seen before,” as reported in an Aug. 9, 2017 Washington Post article. Shortly after, North Korea responded by threatening Guam with Wassong-12s, the intermediate-range missiles unveiled by North Korea last May. Guam is the Pacific island that is home to a massive U.S. Air Force base and U.S. nuclear strategic assets. Although Guam posseses a sophisticated missile-interceptor system that could protect against medium-range missiles, the tension between two countries still remained a global concern. In September 2017, North Korea announced that they conducted their sixth nuclear test on their hydrogen bomb, as reported in a Sept. 2, 2017 New York Times article, and the tension between the two countries flared up again. Due to the conflict, European bourses decreased when equities faced shocks across Asia, the price of the gold experienced a 10-month high, and gasoline futures slid while crude prices remained mixed, as reported by a Sept. 4, 2017 Financial Times article .

According to a Sept. 12, 2017 analysis by Oxford Economics, there are several expected impacts on the global economy from the tensions, especially in Asian countries. First, if the truce between North and South Korea collapses and the two countries enter a direct conflict, business and consumer confidence in South Korea will be unstable and equities and bond markets will be sold out due to the increase in the risk premium on assets. The wealth effect and deterioration in credit condition will likely cause South Korea's aggregate demand to decrease.

Japan would also be greatly affected by such a conflict, and its economy would suffer shocks in both internal and external demands. Due to its location right next to North and South Korea, Japan cannot escape economic instability during and after such a conflict. As in the previous scenario of a possible South Korean slump, business and consumer confidence in Japan would falter in the face of a Korean conflict and Japanese equities would be sold off at a staggering rate. Furthermore, yen, the Japanese currency, would work as an alternative to won, the Korean currency, and become stronger than before. The fall of asset prices would decrease the domestic demand and appreciation of the yen, and lower growth rate compared to other Asian countries would decrease Japan’s external demand.

China is also included in the list of countries that would have the largest influence on the conflict. China publicly acts as if they are the sole stabilizing force on North Korea. When the nuclear threat became a worldwide concern, the Chinese leadership banned North Korea from exporting coal to China and warned North Korea to not raise any other tensions with the U.S. or their allies. However, according to a speech given by Kim Jong-un on April 28, 2017, China increased trade with North Korea by 37 percent during the first quarter of 2017, which is contrary to their tough public facade.

In a Sept. 7, 2017 interview with CNN, Stephen Innes, the head of Asian trading at online broker OANDA, stated, “The key now is how the international community will respond, given how ineffective the tightened United Nations sanctions have been at discouraging North Korea's ambitions,” during the UN Security Council meeting that was held right after the conflict occurred. International trade with North Korea is overwhelmingly China-centric: About 90 percent of non-domestic North Korean trade involves China in some way, according to a Sept. 27 2017 Washington Post article.

Thus, China is the key to putting pressure on the North Korean economy. However, we can safely conclude that China does not have any intention of damaging North Korea’s economy. After the U.N. movement, China announced that they will not agree to any restriction that undermines their interests, according to the same Sept. 2, 2017 New York Times article. Because China has a great deal of influence on the global economy, North Korea indirectly has the power to affect the global economy and world financial market.

If tensions between the U.S. and China were to arise — which is a possible scenario if the U.S. and North Korea remain belligerent and China keeps supporting North Korea — the prices of Chinese equities would be expected to drop, but the U.S. financial markets would likely remain unaffected. Like the other Asian countries analyzed above, Chinese business and consumer confidence would be diminished in the event of Korean conflict.

Due to the instability of the market, especially in Asian markets, emerging market risk premiums will appreciate and result in short-term low domestic demand in China. However, considering the fact that China, Japan and South Korea have huge influence over the global economy, in the long-term, destabilized markets in those countries will lead to an unstable global market. Compared to the issues that the U.S. has had with countries like Cuba and Venezuela, the conflict with North Korea is more pressing since it is closely related to countries that have large influences in the global marketplace. While the issue in the short-term can seem minor and inconsequential in the U.S., it should be solved as soon as possible before it can create a global economic disaster.

Please note All comments are eligible for publication in The Justice.